Starting a business is an exciting and fulfilling experience, but knowing where to begin can be challenging. There are various approaches and crucial factors to consider when launching a business. To simplify the process and increase your chances of success, follow our detailed guide, which covers everything from defining your business idea to registration, launching, and growth.

Get in the Right Mindset Before You Start

Many people hear about overnight success stories, but the reality is often more complex, involving years of planning, building, and preparation before a public launch. It’s important to focus on your own business journey and avoid comparing your progress to others.

Consistency Is Key

New entrepreneurs often feel motivated at the start, but frustration can set in when that initial motivation fades. That’s why establishing routines and habits is essential to keep you moving forward even when motivation dips.

Take Action

Some business owners jump in without planning, while others get stuck overanalyzing and never begin. You might fall somewhere in between, and that’s okay. The best approach is to list all the steps needed to reach your goal and prioritize them. Some tasks may take minutes, while others could require more time, but the key is to keep making progress.

1. Develop Your Business Idea

While many recommend turning a passion into a business, it’s also crucial to ensure your idea is both profitable and aligned with your skills. For example, loving music doesn’t make a business viable if you’re not a talented musician. Similarly, opening a soap shop in a town with three others may make it difficult to stand out.

If you’re unsure what your business should be, ask yourself questions like:

- What do I love doing?

- What do I dislike doing?

- What am I good at?

- What advice do others seek from me?

- If I could give a five-minute speech on any topic, what would it be?

These questions can help you brainstorm or refine your business idea. Once you have an idea, evaluate if you’re skilled at it and whether it has the potential to be profitable.

Choosing the Right Type of Business

Before deciding on a business, think about the following:

- How much funding do you have?

- How much time can you invest?

- Do you want to work from home or a specific location?

- What are your passions and interests?

- Can you sell knowledge or information, such as through courses?

- What support systems are available?

- Are you partnering with anyone?

Consider these popular business ideas:

- Start a Franchise

- Create a Blog

- Launch an Online Store

- Begin a Dropshipping Business

- Start a Cleaning or Landscaping Business

- Offer Consulting Services

2. Analyze Your Competitors and Market

Entrepreneurs often focus more on their products than on studying the competition. If you’re seeking funding, investors will want to know what sets you apart. If the market is already crowded, find a unique approach, like specializing in a niche market.

Primary Research

The first step in competitor analysis is primary research, which involves gathering data directly from potential customers through surveys, questionnaires, and interviews. Avoid relying on feedback from friends and family unless they represent your target market.

Secondary Research

Secondary research involves using existing data from sources like census information. While this data may be useful, it often lacks the detail that primary research can provide.

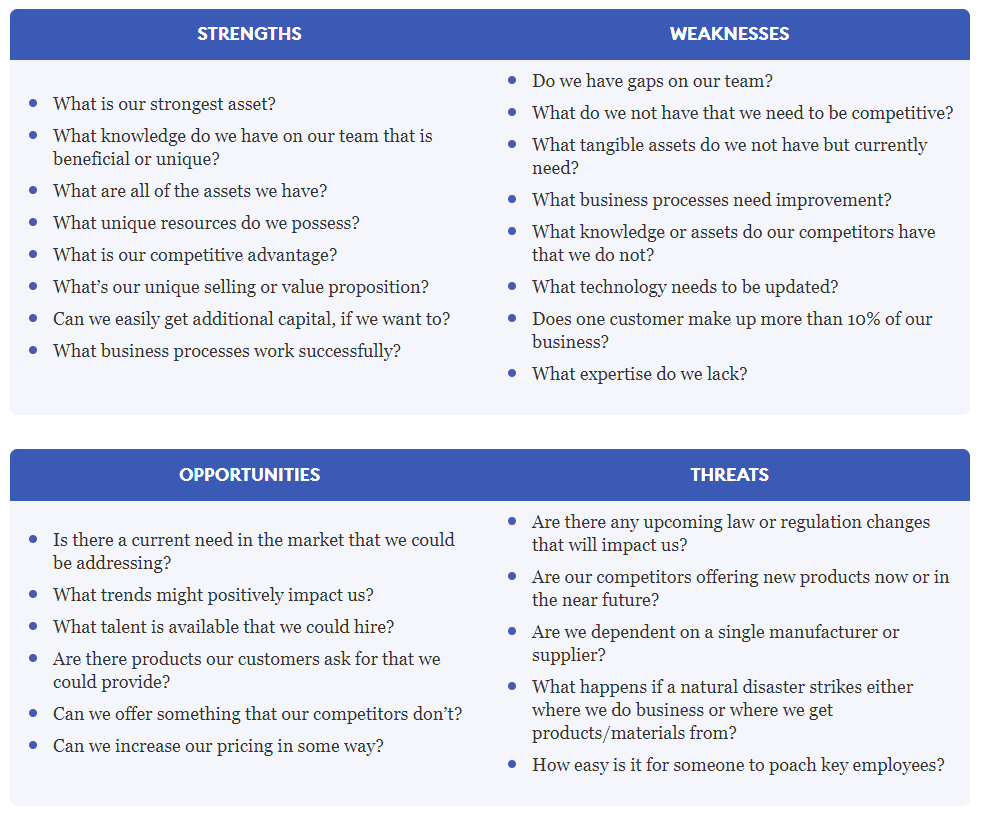

Conduct a SWOT Analysis

SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis helps you evaluate your business idea’s potential success and guide your decision-making. Identifying areas for improvement or market opportunities can refine your business strategy.

3. Develop Your Business Plan

A business plan serves as a blueprint for your new venture, outlining your goals, strategies, and providing a clear path forward. It’s a vital document that makes it easier for investors, financial institutions, and management to understand the business. Even if you’re self-financing, a business plan will help you solidify your idea and identify any potential challenges. A well-rounded business plan should include the following key sections:

- Executive Summary: Though it’s the first section of the business plan, write it last. It offers an overview of the proposed business, summarizing its objectives and the methods to achieve them.

- Company Description: This section explains the problem your product or service addresses and why your business is uniquely qualified to solve it. For instance, if you have a background in molecular engineering and are creating new athletic wear, your expertise would make your product stand out.

- Market Analysis: Here, you assess your company’s competitive position by analyzing the target market, growth trends, and the competitive landscape, including any relevant market segmentation.

- Organization and Structure: Describe your business structure, risk management strategies, and key team members’ qualifications. Include whether your business will operate as a sole proprietorship, LLC, or corporation.

- Mission and Goals: This section includes a brief mission statement and clearly outlines what the business aims to accomplish, with steps that align with SMART goals (Specific, Measurable, Action-oriented, Realistic, and Time-bound).

- Products or Services: Explain how your business will function. Detail the products or services you’ll offer, how they compare to competitors, who will produce them, and the cost of sourcing materials and manufacturing.

- Background Summary: Compile research and data on industry trends that may impact your business. This section requires time and effort to gather and summarize relevant studies and market insights.

- Marketing Plan: Outline the characteristics of your product, summarize your SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), and assess competitors. Additionally, explain your promotional strategies, marketing budget, and campaign duration.

- Financial Plan: The financial plan is critical, as it details how your business will sustain itself. Include a proposed budget, projected financial statements (like income statements, balance sheets, and cash flow statements) for the next five years, and any funding requests if you’re seeking external financing.

Develop an Exit Strategy

An exit strategy is essential if you’re seeking investors, as it explains how you plan to sell the business or transfer ownership when the time comes. This strategy ensures you can maximize the value of your business. Common exit strategies include selling the business, passing it to family members, liquidating assets, or simply closing the business.

Build a Scalable Business Model

To handle growth effectively, ensure your business model is scalable. A scalable model allows you to serve more customers without a significant rise in expenses. Popular scalable business models include subscription services, digital products, franchises, and network marketing.

Plan for Taxes

Planning for taxes early is critical when starting a business. You may be liable for various types of taxes, including income, self-employment, sales, and property tax. Depending on your business type, you may also face payroll or unemployment taxes.

4. Choose Your Business Structure

The structure of your business affects taxes, daily operations, and the liability you hold for business debts. Here are the most common structures:

- LLC (Limited Liability Company): Offers protection from personal liability for business debts. An LLC can have one or more owners (members), and it’s relatively easy to set up.

- Pros: Liability protection for owners, simple setup, can have a single-member LLC.

- Cons: Requires regular state filings, cannot issue stock, involves annual filing fees.

- LLP (Limited Liability Partnership): Typically used by licensed professionals (e.g., lawyers, accountants), requiring a partnership agreement.

- Pros: Partners have limited liability, easy to form, unlimited number of partners.

- Cons: Partners must actively participate in the business, cannot issue stock, partners are liable for malpractice claims.

- Sole Proprietorship: This structure is for solo entrepreneurs, where the owner and business are legally considered the same entity. The owner is personally responsible for all business liabilities.

- Pros: Easy to establish, minimal paperwork, full control of the business.

- Cons: Personal liability for business debts, harder to raise funds, limited business lifespan.

- Corporation: A corporation limits personal liability similar to an LLC, but can be taxed as a C-corp or an S-corp. Larger companies and startups generally use C-corps for venture capital attraction.

- Pros: Owners have liability protection, indefinite lifespan, unlimited shareholders.

- Cons: Subject to double taxation, more complex to set up, shareholders face limited liability.

Before choosing a structure, consult with a small business accountant or attorney to understand how different options impact taxes and liability.

Helpful Resources

- How to set up an LLC

- How to start a Sole Proprietorship

- How to start a Corporation

- How to start a Nonprofit

- How to start a 501(c)(3)

5. Register Your Business and Obtain Necessary Licenses

Once you’ve chosen your business structure, there are several legal steps to follow when starting a business. Here’s a checklist to guide you:

Select Your Business Name

Pick a name that’s memorable but not overly complex. If possible, secure a matching domain name to establish your online presence. Ensure that the name you choose isn’t already in use by another registered business in your state and doesn’t infringe on any trademarks or service marks registered with the United States Patent and Trademark Office (USPTO).

Business Name vs. DBA

There’s a difference between a business’s legal name and a “Doing Business As” (DBA) name. A DBA may be required if your business operates under a different name from its official one. For instance, if “Mike’s Bike Shop” operates as “Mike’s Bikes,” the legal name is “Mike’s Bike Shop,” while “Mike’s Bikes” is the DBA. You may need to register a DBA with state, county, or city offices. The benefits of a DBA include:

- Opening a business bank account under the business name

- Using a trade name for branding products or services

- Acquiring a business license

Register Your Business and Apply for an Employer Identification Number (EIN)

To officially establish your business as a legal entity, such as a corporation or LLC, you must file paperwork with your state’s business agency, typically the Secretary of State. As part of the process, you’ll need to appoint a registered agent to receive legal documents on behalf of your business and pay a filing fee. Once approved, the state will provide a certificate, which you can use to apply for licenses, a tax ID, and a business bank account.

Next, apply for an EIN. Most businesses, except sole proprietorships without employees, are required to obtain an EIN from the IRS, which can be issued almost immediately.

Obtain Necessary Licenses and Permits

Your industry and location will determine the licenses and permits required to legally operate. It’s a good idea to consult your local government office or a legal professional to ensure you meet all the legal requirements specific to your area.

Helpful Resources:

- Best LLC Services

- How to Register a Business Name

- How to Register a DBA

- How to Obtain an EIN for an LLC

- How to Get a Business License

6. Organize Your Finances

Open a Business Bank Account

Keeping your business finances separate from your personal ones is crucial. Here’s a guide on choosing a business checking account and why it’s important. When opening an account, you’ll need your business name and EIN. This account will handle your business transactions, such as paying suppliers and invoicing customers. A separate business account is often required if you plan to apply for a loan or line of credit.

Hire a Bookkeeper or Use Accounting Software

If your business sells physical products, you’ll need accounting software with inventory management features to track stock. The software should also allow for general bookkeeping functions like journal entries, generating financial statements, and managing receivables and payables. Some programs offer all-in-one solutions for invoicing, expense tracking, tax calculations, and financial reports. There are also online bookkeeping services available with features like bank reconciliation and invoicing.

Calculate Your Break-Even Point

Before securing funds for your business, calculate your startup costs. These should include physical supplies, professional services, licenses or permits, and the cost of office space or real estate, as well as payroll if applicable. It’s better to overestimate these costs and have surplus funds rather than too little. Many experts recommend having enough cash to cover six months of operating expenses.

Once you know your startup costs, calculate your break-even point—the point at which your business becomes profitable.

Example:

If you sell miniature birdhouses for fairy gardens and estimate $500 in startup costs with a variable cost of 40 cents per birdhouse and a sale price of $1.50 per unit, you can calculate your break-even point as follows:

- Fixed costs: $500 (first month)

- Variable costs: 40 cents per birdhouse

- Price per birdhouse: $1.50

Formula:

$500 / ($1.50 – $0.40) = 456 units

In this example, you would need to sell at least 456 birdhouses to cover your costs. Selling more than this would result in a profit.

Helpful Resources:

- Best Business Checking Accounts

- Best Accounting Software for Small Businesses

- How to Open a Bank Account

7. Securing Funding for Your Business

There are two main categories for funding: internal and external.

- Internal funding includes:

- Personal savings

- Credit cards

- Help from friends and family

Financing your business this way carries risks, as using personal funds or credit cards means you must repay debts, and a failed business could result in financial losses. Accepting money from loved ones can strain relationships if the business doesn’t succeed. To reduce these risks, consider external funding.

- External funding includes:

- Small business loans

- Grants

- Angel investors

- Venture capital

- Crowdfunding

Small businesses often combine several funding options. Evaluate how much money you need, how soon you can repay it, and your comfort level with risk. Regardless of the source, aim for profitability. Earning six figures with solid take-home pay is often better than generating seven figures with a much smaller profit.

Funding ideas include:

- Invoice factoring: Selling unpaid invoices to a third party at a discount.

- Business lines of credit: Similar to personal lines of credit, with limits based on your revenue and credit score.

- Equipment financing: Loans or leases to purchase business equipment.

- SBA microloans: Loans up to $50,000 for working capital, equipment, or supplies.

- Grants: Federal and local grants are available, especially for businesses that promote innovation or operate in disadvantaged areas.

- Crowdfunding: Raise funds from a large group of people by accepting donations or selling equity in your company.

To choose the best funding option, consider how much you need, repayment terms, and your risk tolerance.

Helpful Resources

- Best Small Business Loans

- Best Startup Business Loans

- Best Loans for Bad Credit

- Business Loan Calculator

- Average Business Loan Rates

- How To Get a Business Loan

8. Obtain Business Insurance

Regardless of your business size or location, insurance is essential. The type of coverage depends on your business and its specific risks. Some policies are legally required, especially if you have employees, such as workers’ compensation insurance.

Work with an Insurance Agent An insurance agent can help determine the necessary coverage and shop for the best rates across multiple insurers.

Types of Business Insurance

- Liability insurance: Protects against third-party claims of bodily injury, property damage, and personal injury like defamation.

- Property insurance: Covers your business’s physical assets, such as your office, equipment, and inventory.

- Business interruption insurance: Covers lost income if your business is forced to close due to a disaster.

- Product liability insurance: Protects against claims related to damages or injury caused by your products.

- Employee practices liability insurance: Protects against employee claims of discrimination, harassment, or wrongful termination.

- Workers’ compensation: Covers medical expenses and wages for employees injured on the job.

Helpful Resources

- Best Small Business Insurance

- Best Commercial Auto Insurance

- Product Liability Insurance Guide

- General Liability Insurance Guide

- 13 Types of Small Business Insurance

9. Equip Your Business with the Right Tools

Utilizing business tools can streamline operations, save time, and help you make informed decisions. Consider incorporating these tools into your business setup:

- Accounting software: Tools like QuickBooks and FreshBooks to manage income, expenses, and tax filings.

- Customer relationship management (CRM): Systems like Zoho CRM and monday.com to track customer data and automate tasks.

- Project management software: Solutions like Airtable and ClickUp to plan, track, and manage projects and resources.

- Credit card processors: Services like Stripe and PayPal for accepting credit card payments.

- Point of sale (POS): Systems like Clover and Lightspeed for processing customer payments, often integrated with accounting and CRM software.

- Virtual private network (VPN): Tools like NordVPN and ExpressVPN to secure sensitive online data.

- Merchant services: Solutions like Square and Stripe to manage customer payments, subscriptions, and billing.

- Email hosting: Services like G Suite and Microsoft Office 365 to create professional email addresses using your domain.

By selecting the right tools and coverage, you’ll be better prepared to protect your business and keep it running smoothly.

10. Market Your Business

Many entrepreneurs invest so heavily in product development that they often neglect to allocate a budget for marketing by the time they launch. Others may become so engrossed in perfecting their products that marketing ends up being an afterthought.

Create a Website

Having a web presence is crucial, even for brick-and-mortar businesses. You can create a website in as little as a weekend. Whether it’s a standard informational site or an e-commerce platform, it’s important to include a page with your business locations and hours if you offer offline services. Additionally, consider adding an “About Us” page, product or service pages, frequently asked questions (FAQs), a blog, and contact details.

Optimize Your Site for SEO

Once your website or e-commerce store is up, the next step is to optimize it for search engines (SEO). This will help potential customers find your site when they search for relevant keywords related to your products. Keep in mind that SEO is a long-term strategy, and you may not see significant traffic immediately, even if you use the right keywords.

Create Relevant Content

Providing quality content on your site is essential for helping customers find the information they need. Content marketing can include videos, customer testimonials, blog posts, and demos. Treat content marketing as a priority on your daily to-do list, as it works hand-in-hand with your social media efforts.

Get Listed in Online Directories

Customers often turn to online directories like Yelp, Google My Business, and Facebook to find local businesses. Ensure your business is listed in as many relevant directories as possible, including those maintained by city halls and chambers of commerce. You might also create listings on directories specific to your industry.

Develop a Social Media Strategy

Your potential customers are active on social media every day, and you should be too. Share content that is interesting and relevant to your audience to drive traffic back to your website, where they can learn more about your offerings and make purchases.

You don’t need to be on every social media platform, but you should definitely establish a presence on Facebook and Instagram, as they offer e-commerce features that allow for direct sales through social media. Both platforms provide free advertising training to assist in marketing your business.

Helpful Resources:

- Best Website Builders

- How To Make a Website for Your Business

- The Best E-Commerce Platforms

- Best Blogging Platforms

- Best Web Hosting Services

11. Scale Your Business

To grow your business, you need to increase your customer base and revenue. This can be achieved by enhancing your marketing efforts, improving your products or services, collaborating with other creators, or introducing complementary products or services.

Consider ways to automate or outsource certain tasks to focus on scaling your business. For instance, if managing social media marketing takes up too much of your time, you might use a platform like Hootsuite for more efficient management. Outsourcing time-consuming tasks entirely is also an option.

Utilizing technology can help automate various business processes such as accounting, email marketing, and lead generation, freeing you up to concentrate on other business aspects.

While scaling, keep a close eye on your finances to ensure profitability. If your earnings aren’t sufficient to cover your expenses, you’ll need to either cut costs or find ways to boost your revenue.

Build a Team

As your business expands, delegating tasks and assembling a team will become necessary for managing daily operations. This may involve hiring additional staff, contractors, or freelancers.

Resources for Building a Team:

- Hiring Platforms: Websites like Indeed and Glassdoor can help you post job descriptions, screen resumes, and conduct video interviews.

- Job Boards: Platforms such as Craigslist and Indeed allow for free job postings.

- Social Media: Use LinkedIn and Facebook to find potential employees.

- Freelance Platforms: Upwork, Freelancer, and Fiverr can connect you with talented freelancers for short-term projects or to outsource specific tasks, such as customer service, social media marketing, or bookkeeping.

You might also explore partnerships with other businesses in your industry. For example, if you’re a wedding planner, collaborating with florists, photographers, catering companies, or venues can create a one-stop-shop experience for your clients.

Another example is an e-commerce store that partners with a fulfillment center to reduce shipping and storage costs, thereby speeding up product delivery to customers.

To identify potential partnerships, look for businesses within your industry that complement your offerings, or those that cater to the same target market but provide different products or services.

Helpful Resources:

- Best Recruiting Software

- How To Hire Employees

- Where To Post Jobs

- Best Applicant Tracking Systems

What are the Best States to Start a Business?

To determine the best and worst states for starting a business in 2024, Forbes Advisor analyzed 18 key metrics across five categories, including business costs, business climate, economy, workforce, and financial accessibility. Check out the full report for detailed insights.

Bottom Line

Starting a small business requires time, effort, and determination. However, with hard work, it can be a fulfilling path to achieving your dreams. Conduct thorough research, develop a solid business plan, and remain adaptable as you grow. Once operational, maintain focus and organization to ensure continuous growth.

Frequently Asked Questions (FAQs)

- How do I start a small business with no money?

- What is the best business structure?

- Do I need a business credit card?

- Do I need a special license or permit to start a small business?

- How much does it cost to create a business?

- How do I get a loan for a new business?

- Do I need a business degree to start a business?

- What are some easy businesses to start?

- What is the most profitable type of business?